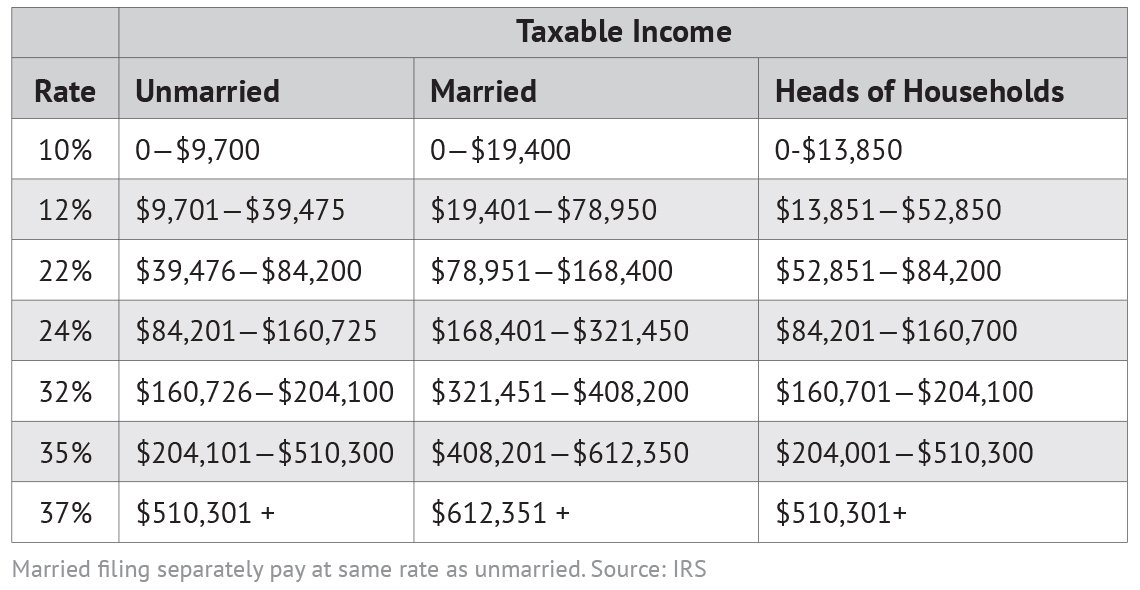

Tax Bracket Calculator 2025. Simply enter your taxable income and filing status to find your top tax rate. For 2025, the irs made adjustments to federal income tax brackets to account for inflation, including raising the standard deduction to $14,600 (up from $13,850) for single filers.

The top marginal income tax rate of 37 percent will hit taxpayers with taxable income above $609,350 for single filers and above $731,200 for married couples filing. These rates apply to your taxable income.

Washington — the internal revenue service today suggested taxpayers who filed or are about to file their 2025 tax return use the irs tax withholding estimator.

2025 Federal Tax Brackets Chart Karyn Marylou, Your taxable income is your income after various deductions, credits, and exemptions have been. Effective tax rate 16.6% estimated.

Tax rates for the 2025 year of assessment Just One Lap, Taxable income and filing status determine. Below are the tax brackets for 2025, detailing the rates from 10% to 37% across different income ranges and filing categories:

Tax Rates 2025 To 2025 2025 Printable Calendar, Taxact’s free tax bracket calculator is a simple, easy way to estimate your federal income tax bracket and total tax. The table below shows the tax brackets for the federal income tax, and it reflects the rates for the 2025 tax year, which are the taxes due in early 2025.

2025 Tax Tables for Australia, 10%, 12%, 22%, 24%, 32%, 35% and 37%. Plus, explore canadian and provincial income tax faq and resources.

Tax Brackets Calculator estimate your taxes, If you want to know your marginal tax bracket for the 2025 tax year, use our calculator. 10%, 12%, 22%, 24%, 32%, 35% and 37%.

Listed here are the federal tax brackets for 2025 vs. 2025 FinaPress, Based on your annual taxable income and filing status, your tax bracket determines your. Wednesday 6 march 2025 14:32, uk.

Tax Brackets 2025 What I Need To Know. Jinny Lurline, Estimate your 2025 refund (taxes you file in 2025) with our income tax calculator by. Taxable income and filing status determine.

IRS Tax Tables 2025 2025, The top marginal income tax rate of 37 percent will hit taxpayers with taxable income above $609,350 for single filers and above $731,200 for married couples filing. Taxable income and filing status determine.

IRS Tax Bracket Calculator Tax Withholding Estimator 2025, 10%, 12%, 22%, 24%, 32%, 35% and 37%. Us tax calculator 2025 [for 2025 tax return] this tool is designed to assist with calculations for the 2025 tax return and forecasting for the 2025 tax year.

Tax Brackets Calculator estimate your taxes, 2025 federal income tax rates. Plus, explore canadian and provincial income tax faq and resources.

Get a quick, free estimate of your 2025 income tax refund or taxes owed using our income tax calculator.